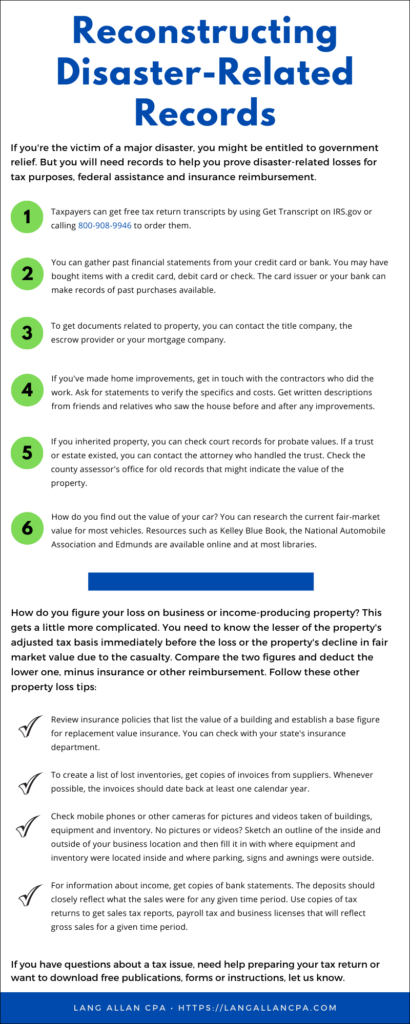

If you’re the victim of a major disaster, you might be entitled to government relief. But you will need records to help you prove disaster-related losses for tax purposes, federal assistance, and insurance reimbursement.

Unfortunately, records may have been destroyed in the disaster. Download our infographic to help walk through the six steps you’ll need.

Plus, follow the property loss checklist items.

This gets a little more complicated. You need to know the lesser of the property’s adjusted tax basis immediately before the loss or the property’s decline in fair market value due to the casualty. Compare the two figures and deduct the lower one, minus insurance or other reimbursements.

If you have questions about a tax issue, need help preparing your tax return, or want to download free publications, forms, or instructions, let us know.

Pingback: Say Buh-Bye to These Tax Credits At Year End | Lang Allan & Company CPA PC