Employers must report employee wages paid, taxes withheld, and their share of certain payroll taxes to the IRS each quarter using Form 941, Employer’s Quarterly Federal Tax Return. Additionally, employers report each employee’s wages and tax withholdings annually on Form W-2 to the Social Security Administration (SSA).

Reconciling Form 941 with payroll records ensures that reported wages, withholdings, and tax liabilities align across all filings. This process helps prevent costly IRS penalties, payroll tax audits, and year-end discrepancies.

For 2025, the IRS continues to focus on payroll tax compliance, including proper classification of employees vs. independent contractors and accurate reporting of COVID-era tax credits, such as the Employee Retention Credit (ERC). Employers should ensure payroll data is correctly reported each quarter and at year-end.

Quarterly 941 Reconciliation

Step 1: Generate a Payroll Register

Run a payroll register for the quarter, listing wages, tax withholdings, and deductions for each employee.

Step 2: Compare Payroll Records to Form 941

Review key areas to ensure they match:

- Number of employees who received wages, tips, or other compensation.

- Total taxable compensation paid to employees.

- Federal income tax withheld from employee wages.

- Taxable Social Security wages and tips (keeping in mind the annual wage base limit, updated yearly).

- Taxable Medicare wages and tips (including Additional Medicare Tax for high earners).

- Total tax payments made, including employer and employee portions of Social Security and Medicare taxes.

Step 3: Identify and Correct Errors

If discrepancies exist, correct payroll records and determine whether an amended Form 941 (Form 941-X) is required.

Common Errors to Watch for in 2025:

- Misclassified Wages – Verify that taxable and nontaxable wages (e.g., pre-tax benefits) are correctly categorized.

- Employee Retention Credit – Ensure prior Employee Retention Credit claims are correctly accounted for, as the IRS closely scrutinizes ERC claims.

- Late or Missing Deposits – Confirm that payroll tax deposits match Form 941 reports.

Year-End 941 Reconciliation

Step 1: Review Annual Payroll Reports

Run a report showing the year’s wages, tax withholdings, and employer tax liabilities.

Step 2: Compare Annual Totals with Form W-2 Data

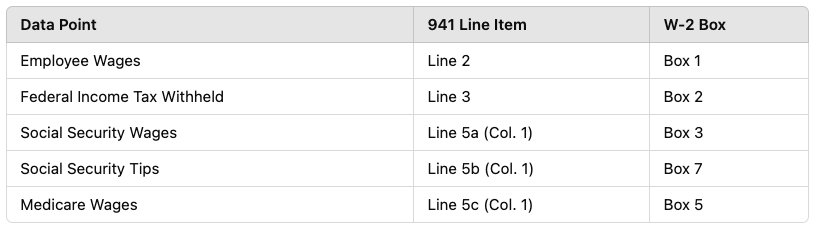

Ensure consistency between the sum of all four Form 941 filings and annual W-2 totals reported to employees and the SSA:

Additionally, confirm that the year’s Social Security and Medicare tax amounts are accurate and comply with IRS limits.

Step 3: Adjust and Correct Errors

If discrepancies arise:

- Amend Form 941 by filing Form 941-X for any affected quarter.

- Correct W-2 Forms by submitting Form W-2c to the SSA if necessary.

Need Assistance? We Can Help!

Payroll tax compliance is complex, and the IRS will increase scrutiny in 2025, particularly for businesses with Employee Retention Credit claims and independent contractor misclassification issues. To avoid errors, penalties, and costly corrections, contact us for a review of your payroll tax filings.