No one likes to think bad things will happen. But what would happen to your business if there was a fire in your office? Here’s why having a disaster recovery plan in place can give you peace of mind. Plus, a ten-step planning checklist and infographic you can download and use to create your plan.

We are all aware of the recent natural disasters, not to mention cyberattacks. Fortunately, people and businesses can recover from these emergencies. They rebuild and move forward.

Understand Plan Goals

It is difficult, but having a disaster recovery plan in place helps your recovery proceed much more smoothly and efficiently.

The goal of a business disaster recovery plan is to have your business up and running in the shortest possible time after the event. Before beginning to form a plan, however, you should perform a risk assessment of your business so that you can identify and correct any potential weaknesses.

Create a Comprehensive Plan

Once the assessment is done, it’s time to create your plan. The following list isn’t definitive, but it provides a guide to the important elements of a comprehensive disaster recovery plan:

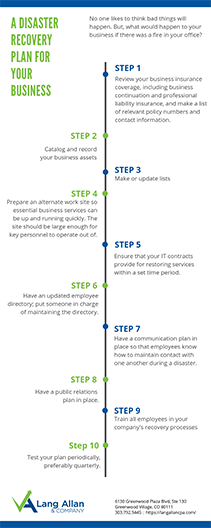

Step 1. Review your business insurance coverage, including business continuation and professional liability insurance, and make a list of relevant policy numbers and contact information.

Step 2. Catalog and record your business assets, including the following:

- Owned equipment (including title documents)

- Leased equipment (including the lessor and the length and terms of the lease; copies of the leases)

- Inventory (including logistical records)

Step 3. Make or update lists of the following:

- Bank accounts, including signatories and contact information

- Employees’ professional licenses and certifications

- Contact information for software vendors and website hosts

- ISP addresses for all company-owned computers

- Information about your company’s health insurance as well as any other important insurance policies

- Key contacts (e.g., accountant, attorney, insurance agent, the company’s leadership team), along with phone numbers and addresses

- Backup for information stored in the cloud or on company servers

Step 4. Prepare an alternate work site so essential business services can be up and running quickly. The site should be large enough for key personnel to operate out of.

Step 5. Ensure that your IT contracts provide for restoring services within a set time period.

Step 6. Have an updated employee directory; put someone in charge of maintaining the directory.

Step 7. Have a communication plan in place so that employees know how to maintain contact with one another during a disaster. Include primary and alternate contacts for key personnel.

Step 8. Have a public relations plan in place. This plan should contain crisis communications (e.g., having a team in place to handle any customer or media inquiries) and a plan to offer assistance to the community if your company isn’t directly affecting.

Step 9. Recovery procedures should include the following:

- Train all employees in your company’s recovery processes, including where to meet if evacuation becomes necessary, who is responsible for coordinating critical functions and who is responsible for recovering business data

Step 10. Test your plan periodically, preferably quarterly.

Every company’s disaster recovery plan will be different, but they should all have one thing in common: They should all err on the side of being overprepared.

Contact us today to get started on your company’s plan.